Don’t get caught out by new solar tax

Households in New South Wales that have done the right thing by installing solar panels are set to get slugged with a solar tax, commonly referred to as a “sun tax”, on the exports from their system. Three NSW electricity network operators are set to introduce fees on households for feeding clean, emissions free electricity into their poles and wires.

Ausgrid, Endeavour Energy and Essential Energy have received the green light from regulators to start charging the new fees. They have been given the seemingly innocuous name of “two-way fees” by the regulator, but they amount to nothing less than a solar tax.

But solar taxes are nothing new. Between 2015 and 2018 the Spanish government imposed a solar tax that applied even to electricity generated on a home or business roof and consumed onsite. It had the impact of slowing down rooftop solar installations in the company with many homes and businesses discouraged by the financial impact it had.

The new NSW solar tax is a different story, and it looks like being a far more durable development. And it could very well spawn copycats in other states.

How the solar tax works

The three NSW network operators received the go-ahead to impose “two-way solar tariffs” back in April, but the shape the new NSW solar tax will shape has begun to become clear.

Ausgrid has published details as to its new tariff structure for homes and small businesses. From July 2024 for 12 months, it will run a trial period – where the new “two-way” tariff will apply on an “opt-in” basis. As of July 2025, it will apply to everyone.

The electricity company manages the distribution electricity network – the poles and wires that distribute energy to homes and businesses in many parts of NSW. It supplies 1.8 million customers.

The electricity company manages the distribution electricity network – the poles and wires that distribute energy to homes and businesses in many parts of NSW. It supplies 1.8 million customers.

Why the term solar tax? Because it will involve a charge for households that export power from their solar system precisely when a solar system is at its most productive.

The Ausgrid tariff will involve a $1.2 c/kWh charge when solar electricity is exported between the hours of 10am and 3pm. On the other hand, it will provide a payment or credit of $2.3 cents/kWh for power fed into the grid during the peak demand period, which is 4pm to 9pm.

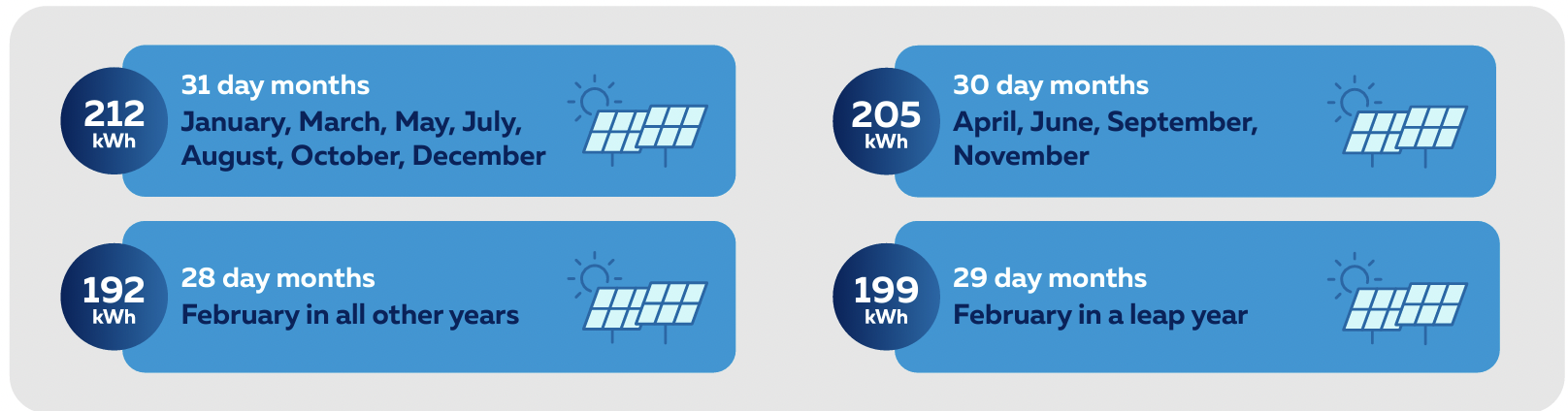

Not all solar power produced by a rooftop system will attract a change, under the Ausgrid scheme. There will a “free threshold”, or an amount of electricity free from an export tariff between 10am and 3pm, that will change each month. The amounts are between 192 kWh and 212 kWh.

As the Sydney Morning Herald observed, it’s a “tale of two households,” with those with batteries or who have them installed benefiting from the change, while homes with a solar system alone losing out. The SMH also crunched the numbers and found that almost 1 million NSW households will be affected by the new fee for PV exports.

Batteries beat the solar tax

There is a clear and obvious way to avoid incurring charges from PV power exports: solar batteries. With a battery, like the Tesla Powerwall, homeowners can store their electricity from their rooftop for use later in the day.

Solar electricity can still be used directly from the roof and in the home, but the battery will charge with the excess – avoiding feeding into the grid and therefore the solar tax charges.

Under the Ausgrid scheme, homes with batteries will be paid rather than penalized. This means that some of the 250,000 Aussie households that have a battery already in place can “opt in” on the Ausgrid scheme today and reap the rewards.

Using a battery in this way won’t impact at all on its regular operation. It will still provide backup power, maximize solar self-consumption, and can be drawn on to power an EV. In fact, limiting feed-in is a key purpose of a solar battery – why reap a miserly feed-in tariff (and now, incur a charge), when you can use your clean solar energy instead of drawing electricity from the grid.

Natural Solar has installed over 12,000 solar batteries Australia-wide and is the largest installer of solar batteries in the country, making us the natural choice for home solar and battery needs to Australian households.

Another way to reduce, albeit not entirely avoid, the “two-way fees” is make better use of the solar energy produced on the roof. This can be done by setting power hungry electrical devices to run during the middle of the day, when PV production is at its highest.

This can be difficult and laborious. Luckily, smart new devices like the Tesla Powerwall can take this task out of your hands and manage devices automatically. While effective, solar batteries remain the only way a homeowner can avoid the solar tax altogether.

Debate about the new charges

Ausgrid claims that the new tariff helps it to fund the works it needs to carry out to “keep the lights on” when a lot of solar is being produced on its network. It says that the fees make the electricity system more equitable for homeowners who are unable to afford a solar system as they should not have to pay for managing to the solar in the grid when they don’t enjoy the benefits of rooftop PV.

Others disagree, including members of the world-leading solar research team at the UNSW. Two recent studies highlight these findings.

In 2020, UNSW researchers looked into the impact high voltage was having on electricity networks where there was a lot of rooftop solar. They found that residential solar was only one factor in causing voltage events on the grid – and that, at the time of the study, it was not excessive.

Another UNSW study from 2021 looked at both the technical and social implications of curtailment – when network operators being able to remotely “switch off” solar systems when there are voltage issues on the grid. It found that people were largely unfamiliar with charges like “two-way fees” and would react negatively to them. They also found that if equity was an issue that governments should act at making solar available to more households, rather than charging for the export to the grid of clean energy.

Beyond NSW

While at present, “only” NSW will bear the brunt of the solar tax. However, there are good reasons to believe that the electricity regulator will allow network operators in other states follow NSW’s lead.

Distribution network operators, like Ausgrid, are regulated monopolies. That means that while a single company is given the opportunity to run a service, the electricity distribution network, without competition, they are regulated in what they can charge by the Australian Electricity Commission (AER). And the AER seems to have caved to pressure by allowing the new fees in NSW and what’s to stop them doing it again.

The AER makes determinations as to the state-based networks on a cyclical basis. Next up is South Australia and Victoria in 2025 – which both have big fleets of rooftop solar. The pressure will likely be mounting.

For homes that have forked out for rooftop solar, doing the right thing for their household budget and the environment, there are good reasons for thinking that the new fees are a slap in the face. When they made the decision to invest in solar panels, there was likely little indication these types of fees were in the pipeline.

The NSW solar tax looks like network companies shifting the goal posts after the game is well underway.

Don’t get caught out by the NSW solar tax. You can avoid the charges today, and even benefit from the new scheme, by installing a home battery system. Get your quote for a cutting-edge solar battery from Australia’s most experienced battery installer, Natural Solar.

These costs are based on the SA Power network in Adelaide but prices may vary depending on your circumstances. This comparison assumes a general energy usage of 4000kWh/year for a residential customer on Energy Locals Time of Use Tariff – (TOU – Peak, Off-Peak & Solar Sponge).

The reference price is set by the Australian Energy Regulator (AER) for a financial year in relation to electricity supply to residential customers in the distribution region and is based on an assumed annual usage amount. Any difference between the reference price and the unconditional price of a plan is expressed as a percentage more or less than the reference price. The terms of any conditional discounts are shown, along with any further difference between the reference price and the discount applied if a condition is met, expressed as a percentage more or less than the reference price.