Two of Australia’s biggest retailers are hiking electricity prices for customers on variable rate contracts by as much as 30%. The ABC reported the massive rises from AGL and Origin Energy, which will impact customers in New South Wales, Queensland, Victoria, and South Australia.

The huge rise in retail electricity costs for households and businesses come despite record solar output dampening wholesale price increases, as it plays an important role in generation. And when you take a closer look at the market dynamics underpinning the higher wholesale prices, it points to the critical role batteries big and small can play in reducing Aussie energy costs in the future.

With colder temperatures leading many to switch off electric heaters rather than pay for the energy costs, the timing of these latest price hikes couldn’t be worse. The Australian Energy Regulator (AER) set the stage for the increase in May when it ruled that the “default offer tariff” would increase from between 21% to 24%.

AGL and Origin Price Increases

But it seems that AGL and Origin are blowing past the “default” determination from the regulator. AGL is increasing prices by up to 29.8% in South Australia and 29.7% in NSW. Origin isn’t so far behind, delivering an increase of 25.5% for its Victorian customers, and 24.2% in South Australia.

For small businesses, the ABC reports that Origin will increase annual electricity costs by an average of $1,133 in South Australia, $918 in New South Wales, $705 in Queensland, and $590 in Victoria.

These increases are truly astronomical and will represent a major drain on household budgets, particularly for those that can least afford it. There is relief being provided by low-income households, and AGL points to its Power On hardship program – which will “absorb” the cost of the increase.

But the average middle-class household won’t qualify for hardship assistance and will have to find a way to balance their budget. And here, an investment in rooftop solar is the obvious solution, delivering savings on day one and protecting households from price increases long into the future.

The ABC compiled the table below, which sets out the electricity price increases for households.

| Average price increases for residential customers on variable rate market contracts | ||||

| NSW | VIC | QLD | SA | |

| AGL | $540 (29.7%) | $341 (25.5%) | $447 (26.4%) | $565 (29.8%) |

| Origin Energy | $407 (21.1%) | $361 (25.5%) | $347 (21.6%) | $405 (24.2%) |

Source: Australian Broadcasting Corporation

The hikes come into effect on July 1 for customers in New South Wales, South Australia, and Queensland and on August 1 in Victoria.

Prices rise as they fall

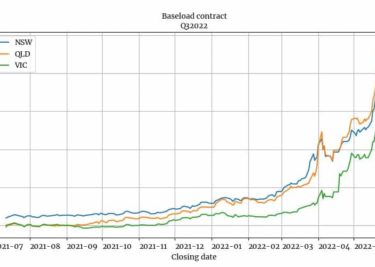

When you look a bit closer, the electricity price increases may not seem to make a lot of sense. While wholesale prices skyrocketed in 2022, a result of the war in Ukraine sparking higher global coal and gas prices, they have since declined off these peaks.

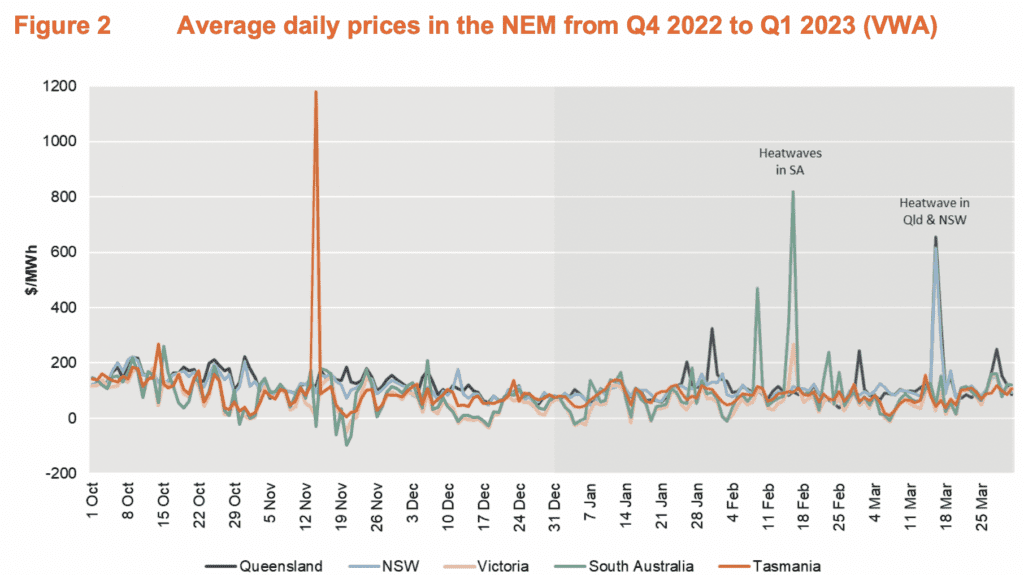

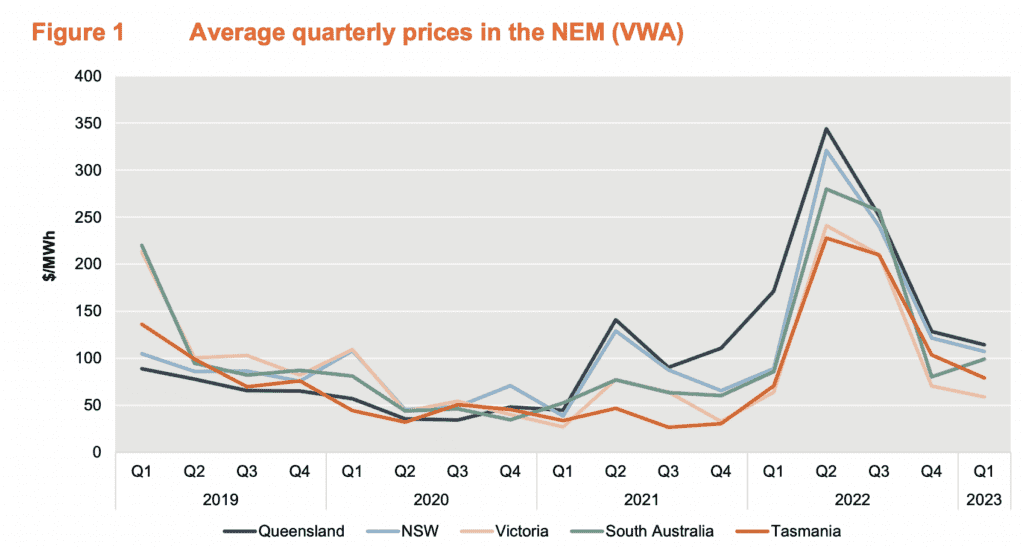

The chart below from the AER’s latest Wholesale Markets Quarterly Report paints the picture. While prices shot up in the first quarter of 2022, they began declining around mid-year – a trend that continued into the second quarter of this year. While not yet published, the report including prices from the second quarter of this year will make for interesting reading.

Some people much smarter than me argue that the system for setting prices is out of date. One such person is Professor Ariel Liebman – director of the Monash Energy Institute. Speaking to Renew Economy last month, Liebman argued exactly that, adding that retailers often offer prices higher than the “default market offer” – which is exactly what AGL and Origin are doing.

“What makes this particularly counterintuitive and frustrating is that while wholesale energy prices had come down in recent months, users will end up paying more based on wholesale hedge contracts locked in by retailers often 12 months ago or longer,” said Liebman.

Nonetheless, under the current system, higher prices for the utilities yesterday mean higher prices for you today. And even though the regulators say jump, the electricity retailer itself gets to say by how high.

A better deal? Try solar batteries

Given the current setup of the electricity market, the hands of many consumers solely relying on retailers are tied when it comes to taking control of the electricity costs and avoiding unfair increases. While you can try to shop around for a better deal, and some state governments are trying to encourage people to do just that, there are a limited number of electricity retail offers available.

But if you make the investment in a high-quality rooftop solar system today for your home you can avoid price shocks for the 20-plus years that it will be in operation. And if you max out your roof space and electrify your heating, cooktops, and invest in an EV, you can take control of your energy supply and insulate yourself from the energy impacts of wars overseas and antiquated market regulations.

There’s an additional advantage also: by installing rooftop PV and adding a residential solar battery, you become a part of the solution – driving prices down for your neighbours and community long into the future.

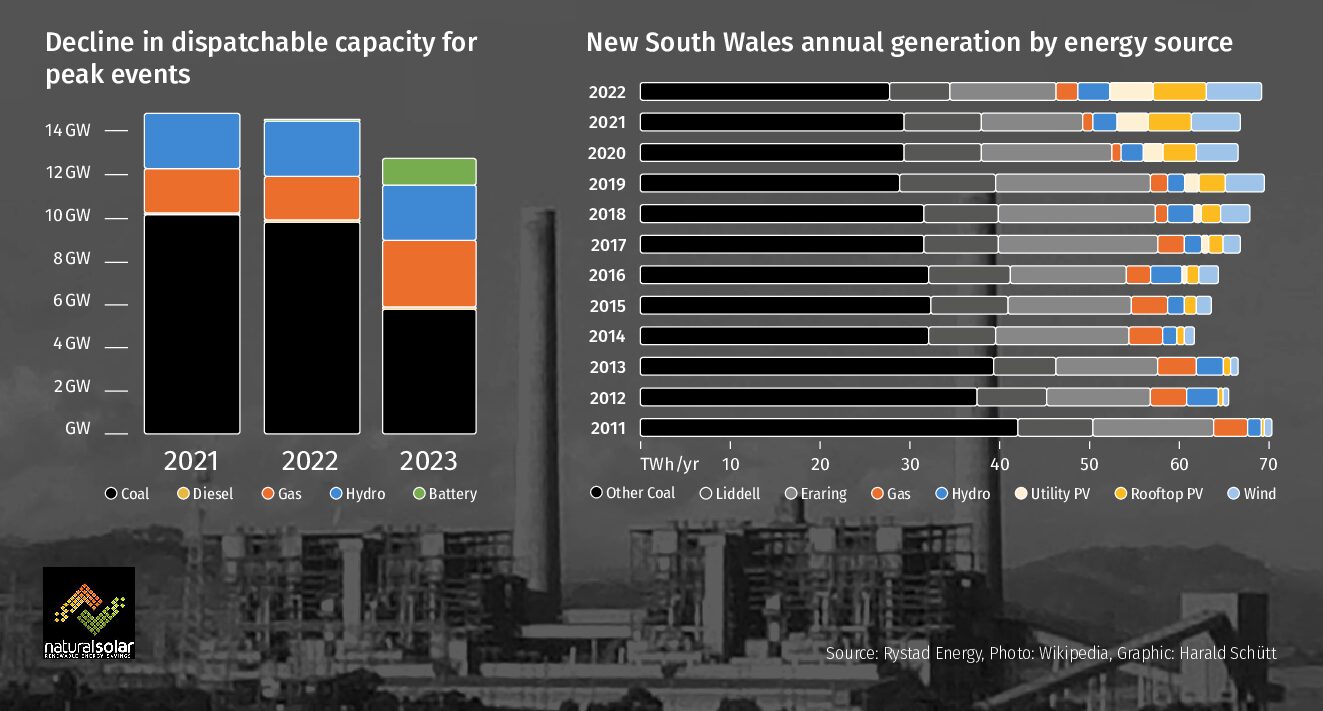

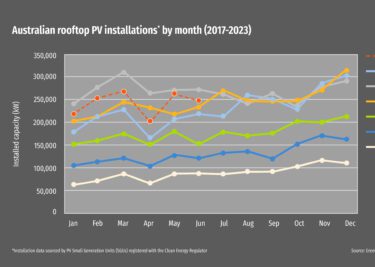

In its most-recent report the regulator, the AER, noted that record levels of electricity generation from solar was helping to drive down wholesale prices. It found that the contribution to Australia’s energy from big solar farms increased 22% in the first quarter of 2023 compared with the year before, and 11% from Q4 2022 – which itself was a record high.

“Rooftop solar also produced record output,” the AER reported. “As a result of this strong solar output, Q1 2023 also saw a record number of negative prices for a first quarter, putting downward pressure on overall prices.”

The case for energy storage

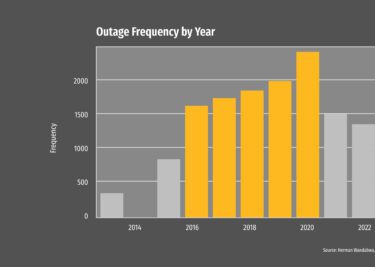

Before I sign off from this post, there’s another development that’s worth another look. Just as higher wholesale prices in 2022 are resulting in hikes for consumers in 2023, short periods of very high prices can mean higher prices overall. And on almost 10 occasions over six months, wholesale prices shot up in various states – generally because of very hot temperatures and everyone cranking their air conditioning at the same time.

In regulator speak, these “acute high-price events” drove up average prices for the first quarter of this year: by 13% in South Australia, 11% in Queensland and 7% in NSW. The AER noted that the high prices tend to kick in during the early evening – as electricity from solar is dropping off.

“These high-price events were concentrated in evening periods where solar output was relatively low,” wrote the AER.

Things don’t have to be this way. Modern home batteries can store solar energy efficiently and safely for use when you need it. The power your rooftop PV produces when the sun is at its peak can power your air conditioning – making your home a sanctuary from the heat and an important part of the solution to the problem of ever-increasing electricity prices.

But right now, heatwaves and summer peaks seem a long time away. And with electricity prices hitting home, by almost 30% for some customers, there will be forgoing heating this winter to save on their energy bills. It is a sorry situation, particularly when we have the solution – rooftop solar and home batteries – at hand.