Small businesses considering investments to electrify and add a solar battery system to reap energy bill savings are set to pick up an additional tax deduction under a new, just announced scheme. It’s called the Small Business Energy Incentive, which provides a bonus 20% tax deduction on investments into things like heat pumps and batteries, and was first announced by the federal government on Sunday April 30 – with the funding confirmed in the 2023-2024 budget today.

But there’s a catch: there is only a 12-month window for investments to qualify. The electrification upgrade, or energy storage device, will have to be purchased, installed, and up-and-running within the next financial year.

“Eligible assets or upgrades will need to be first used or installed ready for use between 1 July 2023 and 30 June 2024,” the Australian Tax Office (ATO) specified on its website.

Businesses with less than $50 million in annual turnover will qualify for the additional tax deduction. Investments of up to $100,000 will qualify for the additional 20% tax deduction.

The ATO listed the types of investments that qualify as “electrifying … heating and cooling systems; upgrading to more efficient fridges and induction cooktops; and installing batteries and heat pumps.”

The government has set aside up to $314 million for The Small Business Energy Incentive. The Energy Efficiency Council (EEC) said that it could spur investments of up to $1.5 billion by Aussie small businesses.

“We know that rapid increases in energy prices have hit small businesses hard,” said the EEC’s Luke Menzel. “Making it easier for them to invest in energy efficiency and electrification helps them take control of their energy costs in the short term and will boost their competitiveness for years to come.”

Quick action required

But to reap these long-term rewards, businesses will have to act fast. Given the current energy environment, demand is high for energy-saving upgrades. Companies like Natural Solar are seeing very strong demand from businesses and homeowners to pull the plug on gas heating, upgrade devices, and go big on solar and storage to take control of their energy supply and lock in long-term savings.

This means that it’s a constant challenge to keep lead times low. And with an energy squeeze taking place all around the world, there is competition for things like solar batteries and heat pumps from far and wide.

If you want a quote for a commercial battery energy storage system for your small business, we’ve created a simple form that can deliver you a quote in minutes. Simply fill out the form here.

It is true that long-term investments into energy upgrades for any home or businesses isn’t an overnight decision. But the additional 20% deduction will likely give many business owners the confidence to make the call.

“Tradies, manufacturers, restaurants, hairdressers, real estate agents and other small businesses are the backbone of communities across Australia,” said Treasurer Jim Chalmers in announcing the tax deduction bonus. “This incentive helps ensure these businesses share in the benefits and opportunities of the energy transition that’s now underway.”

While there’s limited detailed information about the Small Business Energy Incentive at this stage, the bonus tax incentive, plus existing tax deductions, and the energy savings, all mean the case for making an investment decision sooner rather than later is a compelling one.

Café example

As an example, take your average small café owner. They very likely have had to face steep increases in their electricity bills over the past year and some frankly crazy gas bills for heating over winter and for their gas cooktops. If they were to upgrade their fridges/freezers, switch their gas heating in winter to heat pumps, ditch gas burners for induction cooktops, and add a battery to buffer the additional electricity demand, the energy efficiency investment could come in at $80,000.

If they get the plans in place, make their order, and have the upgrades installed on the first of the 2023/24 financial year, the additional tax deduction would stand at $16,000 in that first year alone. Assuming an annual tax depreciation rate of 10% for those assets, there would be an additional deduction of $8,000 each year for the next decade.

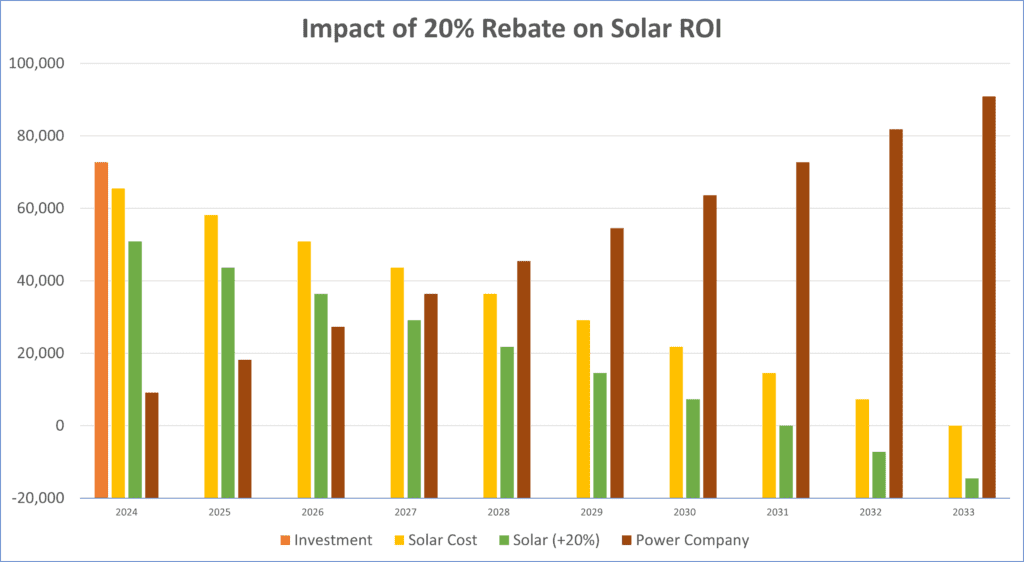

Assumptions

Solar and Battery Purchase $72,700.

Annual power company bill is 1/8 of solar system cost.

Definitions

Investment: Amount spent on installation

Solar Cost: Investment less 10% annual deprecation

Solar Cost (+20%): Investment less 10% annual deprecation and 20% rebate

Power Company: Estimated cost of non-solar energy at 1/8 of solar instal cost (8 yr ROI)

In short, in the first five years the café’s energy investment will have almost paid for itself in tax deductions – to a tune of $56,000. Importantly, as the EEC head Menzel argues, these investments in electric and energy efficient devices will deliver serious savings on energy bills over the same period, and that’s not to mention that the café’s energy will now be highly decarbonised, and energy bills. What’s more, by replacing things like heating or gas stovetops with electric devices, it can all be powered with a rooftop PV system, bolstered with a solar battery system to ensure the electrons produced on the roof are put to good use.

The outcome amounts to long term savings on a well-timed investment. That’s an “energy incentive” to act today, in anyone’s books.