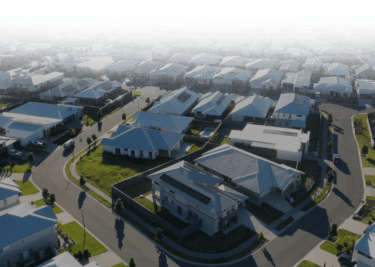

Adding a rooftop solar system is a no-brainer for Aussie homeowners in 2023. Coupling it with a home battery energy storage system is increasingly making sense for an increasing number of households too; allowing people to use their own clean and reliable solar energy when and where they need it.

It now looks like the value that adding solar and batteries to existing homes is set to be recognized in a new way, through the expansion of the national energy performance rating scheme to existing homes. Previously, it had only applied to new builds.

The move was announced last week by the federal government. A statement issued by the federal Treasurer, Assistant Treasurer, and the Energy Minister summed it up it pretty well.

“At the moment, Australians have access to more information on the energy efficiency of their washing machines than they do their homes.”

The new initiative will “expand and upgrade” the energy rating system for homes – the Nationwide House Energy Rating Scheme NatHERS”. This will make it possible to have existing homes rated under the system, to find out how close to five-stars a home will get for energy efficiency, and what can be done to improve it.

“People will be able to seek a star rating of their home’s energy performance – helping Australians make the best choices for their hip pocket when it comes to energy upgrades and renting and purchasing homes.”

What’s exciting about the move is that it will make clear the value of clean energy investments that a household makes. Add rooftop PV, tick. Bulk up insulation: tick. Switch to a heat pump for heating and cooling: tick.

We’ve known for a long time that these improvements add to the value of a home at resale, but now there will be a process for getting a home assessed, and a standard against which the efforts can be measured.

“We’re also working with banks to pilot ways to add energy performance into the set of factors valuers assess when they do house assessments, using this star rating system,” the statement continued.

Things have moved fast over the past decade in terms of solar and home battery technology. Prices have plunged and the efficiency of the products has gone through the roof. The same is likely to be the case for other things like EV chargers, and other energy efficiency upgrades that can be carried out.

Given this rapid rate of technological change, it shouldn’t be surprising that banks need some assistance in making sense of what kind of value these improvements make to the home. And it’s encouraging that they’ll now have some independent help to assess their true value and take it into account when assessing the value of a home.

Cheaper finance

Another major benefit of the expansion of the NatHERS is that it could result in access to cheaper loans from the bank to invest clean energy upgrades to homes. Everyone knows that home renovations and upgrades can be costly, and with interest rates on the up, being able to access cheaper finance can help get project over the line.

“This new information about the energy efficiency of houses will help accelerate home upgrades – by helping households find saving opportunities, incentivising banks to lend more capital to Australians to make their homes more energy efficient, and helping these loans be verified as green investments,” the government statement reads.

“In response to the improved ratings system, some banks have announced expansions of green product offerings for home loans and residential energy performance upgrades.”

While these loans won’t materialize overnight – with Westpac telling the Sydney Morning Herald that it will take some time for the loans products to be developed, the banks were positive about the development.

“This gives us better information to be able to design those solutions,” Westpac’s chief sustainability officer, Siobhan Toohill told the SMH.

Green finance

I can’t help feeling that it is instructive that this initiative, to expand NatHERS and provide the banks with better ways to value and provide finance to carry out energy upgrades to our homes, came as a result from a series of talkfests the government is hosting with the investment community.

This latest initiative came off the back of the second Investor Roundtable meeting, where the government is bringing together banks, big investors, and fund managers – including the superannuation funds that manage most of our retirement savings.

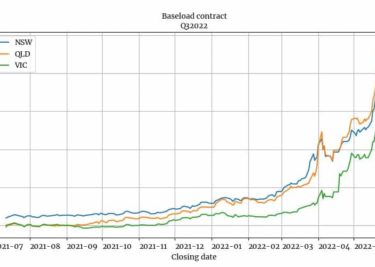

These big investors are all a part of a global trend that is seeing money pouring into “green investment” – which is increasingly seen by money markets as not only being good for the environment, but also for good for business.

In one small way, Natural Solar’s acquisition, in October 2022, by our awesome parent company 1KOMMA5 is an example of this trend. Big investors are looking at ways that they can accelerate the uptake of things like rooftop solar and home batteries by bringing to together leading companies in the space, allowing us to grow more quickly and serve our customers better.

Big banks and fund managers are also looking to get into the action. By applying the NatHERS system to existing homes, which make up the vast bulk of Australia’s housing stock, the banks can create loans products to carry out the kind of improvements that result in cheaper energy bills for homeowners and reduce carbon emissions.

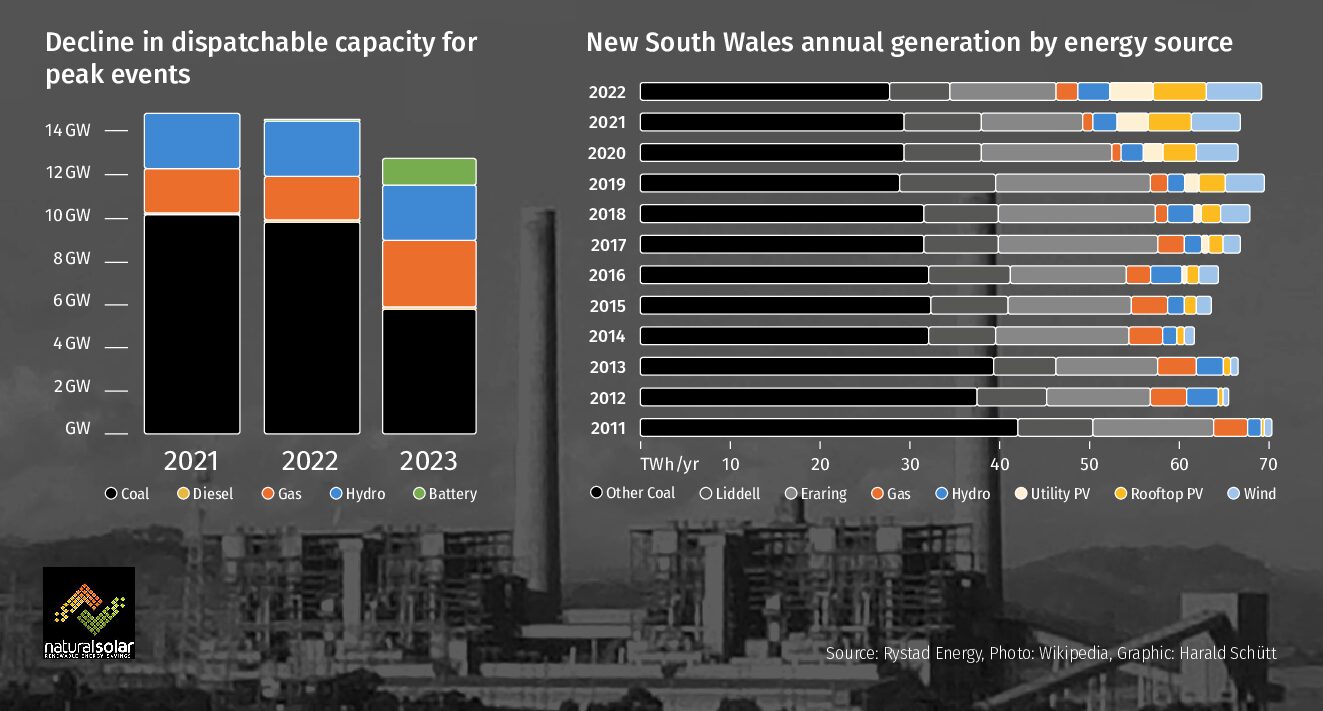

Over the past few years, we’ve witnessed how important individual households can be in Australia’s energy transition. By electrifying the home, through a heat pump, convection stovetop, and EV – powered by a rooftop PV, supported by a home battery, and coordinated by a home management system like the Heartbeat – climate emissions across a street, neighbourhood, and across the country can be slashed. Many homes light work of action on climate change, you could say.

And so why wouldn’t the big end of town want to get involved in this transition. The big lenders and financiers don’t want to miss out on the huge investment opportunity that exists in Aussie homes and suburbs.

Last week’s announcement might seem like an adjustment to a program that many of us wouldn’t think so much about. But on closer inspection it seems like a five-star solution to meet the needs of homeowner and investors as they look to plan and invest in impactful energy renovations.