This article originally appeared in SMH.

A deluge of rooftop solar power pouring into the electricity network is causing network traffic jams, prompting the energy market rule-maker to propose new regulations to smooth the torrent of household power into the grid and offer incentives to drive the use of home batteries.

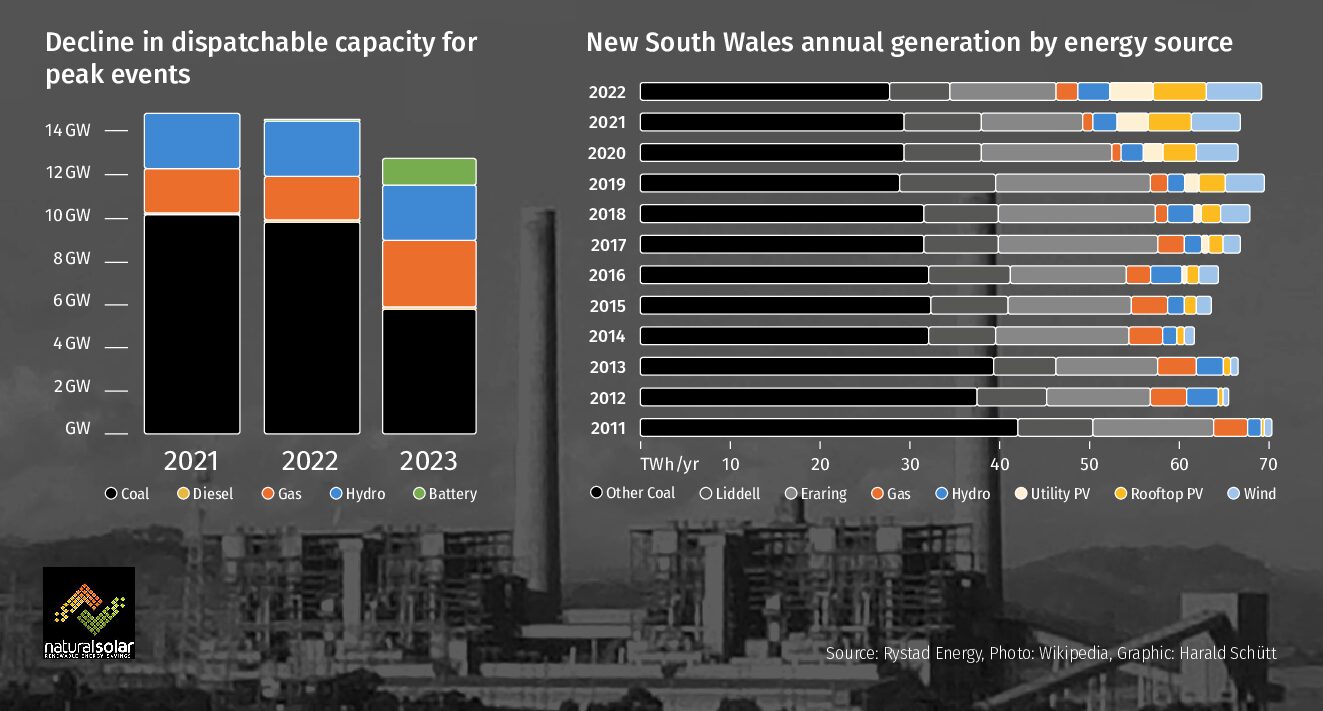

Networks were built decades ago when power only flowed from big coal and gas-fired generators directly to customers’ homes. Now power lines are groaning under the strain of Australia’s world-leading solar power installation, which is forecast to grow from 2.6 million energy customers, or 20 per cent of households, to 50 per cent in the next decade.

Currently, network operators are scrambling to limit the volume of power flowing back into the grid by liming how much homeowners can sell into it, curbing the returns they make on their investment into panels that cost thousands of dollars.

The Australian Energy Market Commission released proposed rule changes on Thursday to allow networks to offer financial incentives to homeowners who avoid sending power to the grid in the middle of the day but export it at night instead. This would encourage greater uptake of home batteries, which could store power generated during the day.

It also made a more controversial proposal that would allow networks to charge solar panel owners for sending power to the grid when the network is most congested, such as in the middle of a sunny day.

In Victoria, excess supply is already causing four of the state’s five network operators to impose solar export limits on households with rooftop panels to prevent disruption to the state power grid.

The AEMC said its rule changes would prevent the need to invest in new network capacity to cope with an excess of power supply. That would limit network charges, which comprise about half the cost of retail electricity bills.

“One option to deal with more solar traffic – building more poles and wires – is very expensive and ends up on all our energy bills whether we have solar or not,” AEMC chief executive Benn Barr said.

“It’s important to do this fairly. We want to avoid a first-come, best dressed system because that limits the capacity for more solar into the grid.”

The AEMC modelled likely scenarios that showed that under the proposed changes an average household customer — including those without rooftop panels — would get a small reduction of up to $25 in their annual bill. But customers with solar panels would take a small hit on their earnings.

A customer with a typical solar system with a capacity between two to four kilowatts, who on average earn $645 a year for sending power to the grid, would receive $30 less under the rule changes.

The AEMC warned a “do-nothing” approach would see congestion grow and cause restrictions on power export. If implemented for 10 per cent of the time for customers with an average size system, they could see a reduction in annual revenue of around $30, or $80 if exports are

restricted for 25 per cent of the time.

The proposed rule changes don’t mandate the price options to customers, which would be left up to network operators to agree with the market regulator.